City Budget

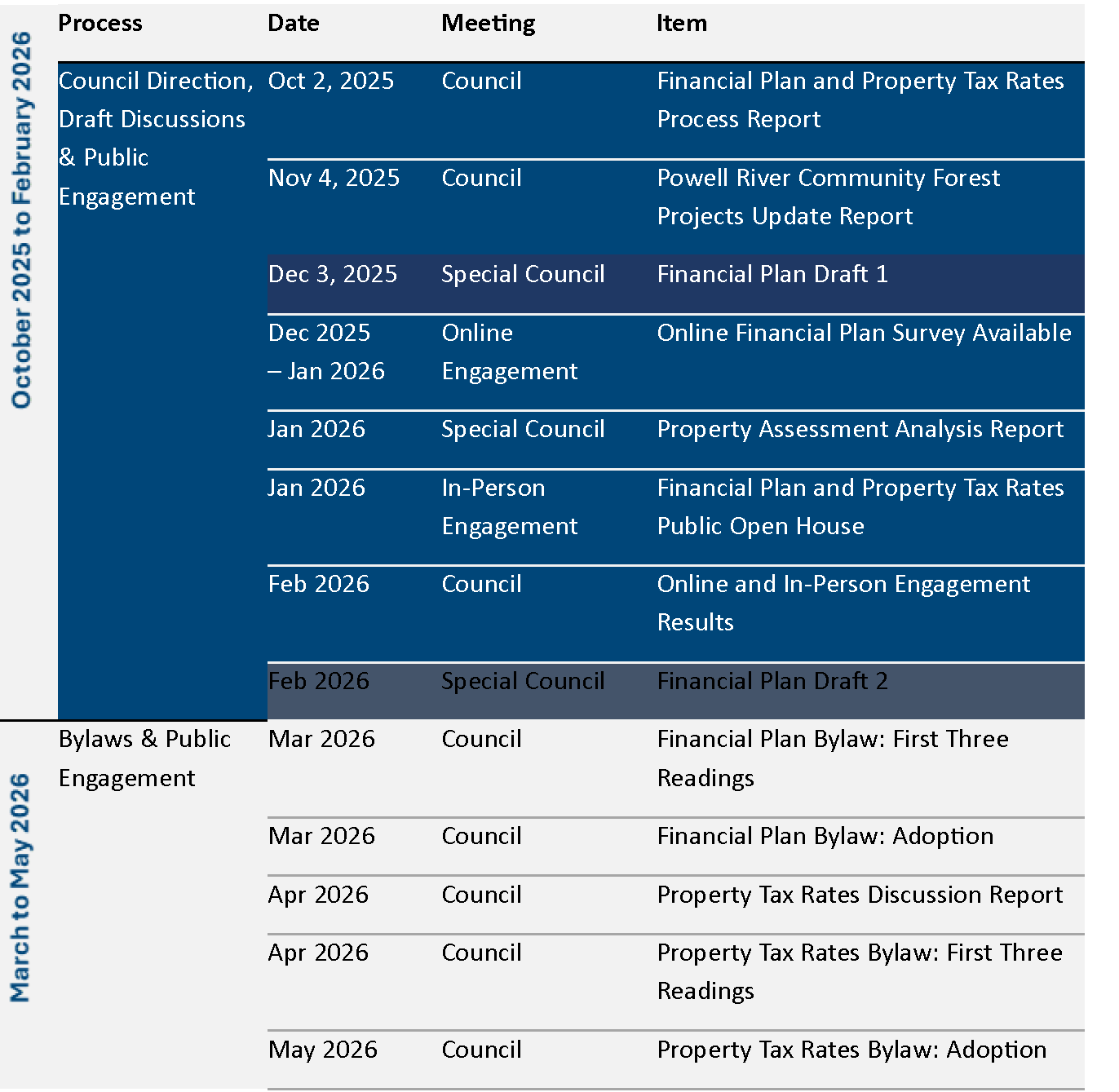

Welcome to the City of Powell River’s Five-Year Financial Plan webpage. The City is required under the Community Charter to adopt a balanced five-year financial plan before May 15th each year. The City’s process and schedule for completing its 2026 – 2030 Financial Plan, which includes opportunities for public feedback and engagement, is outlined below.

2026 – 2030 Financial Plan Reports

Financial Plan reports are provided to City Council on a regular basis for Council’s input and direction. These reports are presented at public meetings to ensure transparency and accountability. As the 2026 – 2030 Financial Plan process progresses, the reports to Council will be added here.

The City charges sewer parcel taxes to help fund the capital and operating costs of its sewer collection and treatment/disposal services. These taxes are charged based on a property’s frontage in feet, multiplied by the parcel tax rates as set in the parcel tax bylaw.

Sanitary Sewer System User Fee Rates

The City charges sewer user fees to help fund the operating cost of the sewer collection and treatment service. The user fee rates are set out in the sewer system user fee bylaw.

Water System User Rates

The City charges water user fees to help fund the capital and operating costs of its water treatment and distribution service. The user fee rates are set out in the waterworks regulations and rates bylaw.

Property taxes are one way the City of Powell River collects revenue to pay for municipal services like police, firefighting, recreation, parks, and programs to build a healthier and thriving coastal community. The amount you pay is based on the funds that the City needs to provide municipal services each year, and your property assessment. More information on 2026 Property Taxes will be forthcoming as the City moves through its 2026 – 2030 Financial Plan process and schedule.

Provincial Property Tax Deferment Program Information

The Property Tax Deferment Program is a provincial loan program that permits qualified BC home owners to defer their annual property taxes on their principle residence if certain criteria are met.

Provincial Home Owner Grant Program

The home owner grant program reduces the amount of property taxes you pay each year on your principal residence. The grant is available to eligible homeowners who pay property taxes.

Financial Services

financecontact@powellriver.ca

604-485-8620

Hours

8:30 am - 4:30 pm (excluding holidays)

Monday – Friday

Closed on all statutory holidays